MyHassad

Unlock the chance to win valuable cash prizes and step into the world of MyHassad.

Learn more

KFH Mobile Banking application for

smartphones with you

all the times...!

Open new account

Open new account Transfer Money

Transfer Money

Open fixed deposits

Open fixed deposits Request Credit Card

Request Credit Card

In the news..

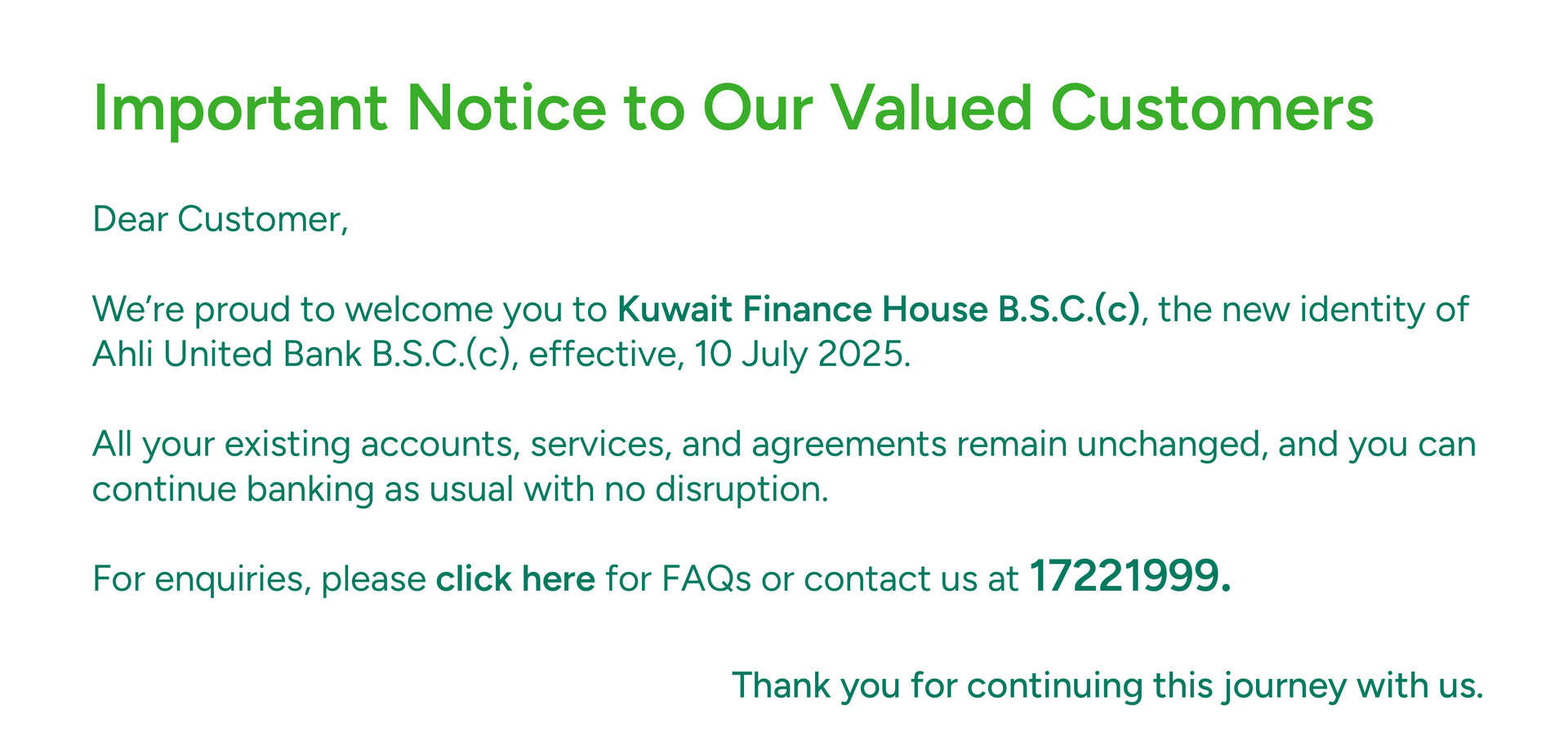

Ahli United Bank Announces Its New Identity as Kuwait Finance House

Manama, Kingdom of Bahrain: Ahli United Bank B.S.C. (c), a leading Islamic bank in Bahrain, has announced the start of a new chapter in its banking history under the name “Kuwait Finance House B.S.C. (c).”

Read more →